uber eats tax calculator canada

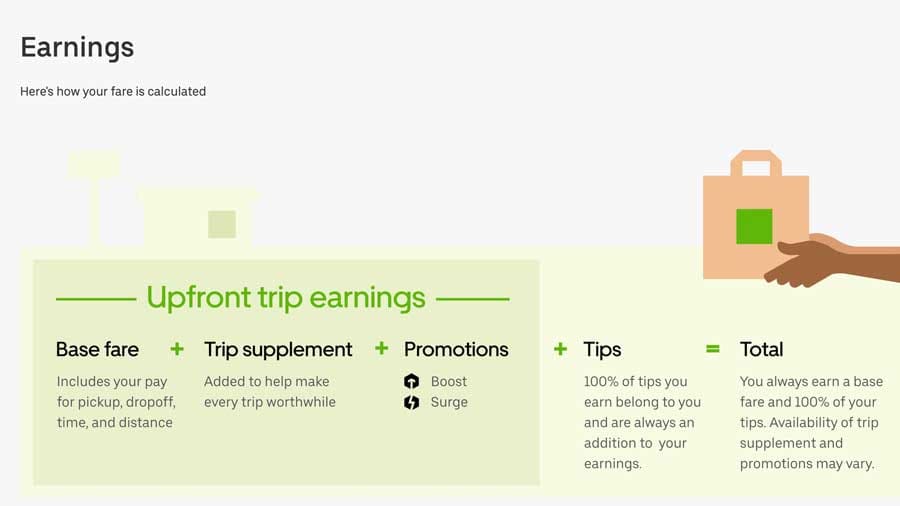

This applies to earnings on both Uber rides and Uber Eats. Your average number of rides per hour.

Delivery Driver Tax Deductions Doordash Grubhub Uber Eats Instacart

The average number of hours you drive per week.

. The rate you will charge depends on different factors see. Every UBER driver must register with the Canada Revenue Agency and provide the agency with an HSTGST number. All you need is the following information.

The following table provides the GST and HST provincial rates since July 1 2010. If you want to get extra fancy you can use advanced filters which will allow you to input. Type of supply learn about what supplies are taxable or not.

Follow the step-by-step instructions to register. It only takes a few minutes to register online and youll have your GSTHST number instantly. The local tax rate in Ontario is 13.

Where the supply is made learn about the place of supply rules. Heres the thing. The provincial tax rate is 5.

Regardless of whether the driver earns at least 100000 in revenue per year or if it is deemed to be a small supplier by CRA a driver can still get a license. The city and state where you drive for work. Your federal tax rate may range from 10 to 37 and your state tax rate can range from 0 to 1075.

For income taxes its only when youve made more than about 53000 as a single person or 106000 as a married couple that your income tax rate goes higher than the 153 self-employment tax. Being a food delivery driver for other gigs like Doordash Grubhub Instacart etc. The exact amount youll pay is regulated by your state as well as your tax bracket which would depend on your annual income.

The Canada Revenue Agency requires every ridesharing driver to create a GSTHST account number which must be shared with Uber within 30 days of a first trip. The first one is income taxes both on federal and state levels. However much of this is similar for other gigs like.

Uber Drivers Lyft drivers and other rideshare drivers. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue. Who the supply is made to to learn about who may not pay the GSTHST.

As a gig economy contractor your self-employment taxes are almost always higher than income taxes. This Uber Eats tax calculator focuses on Uber Eats earnings. This article is not meant to completely explain taxes for Uber Eats drivers.

You are responsible to collect remit and file sales tax on all your ridesharing trips to the Canada Revenue Agency CRA. Using our Uber driver tax calculator is easy.

What Percentage Cut Does Uber Take From The Total Fare Cost Of A Ride Do They Subtract A Flat Fee For Each Dispatch Or A Percentage Are There Initiation Monthly Fees To Be

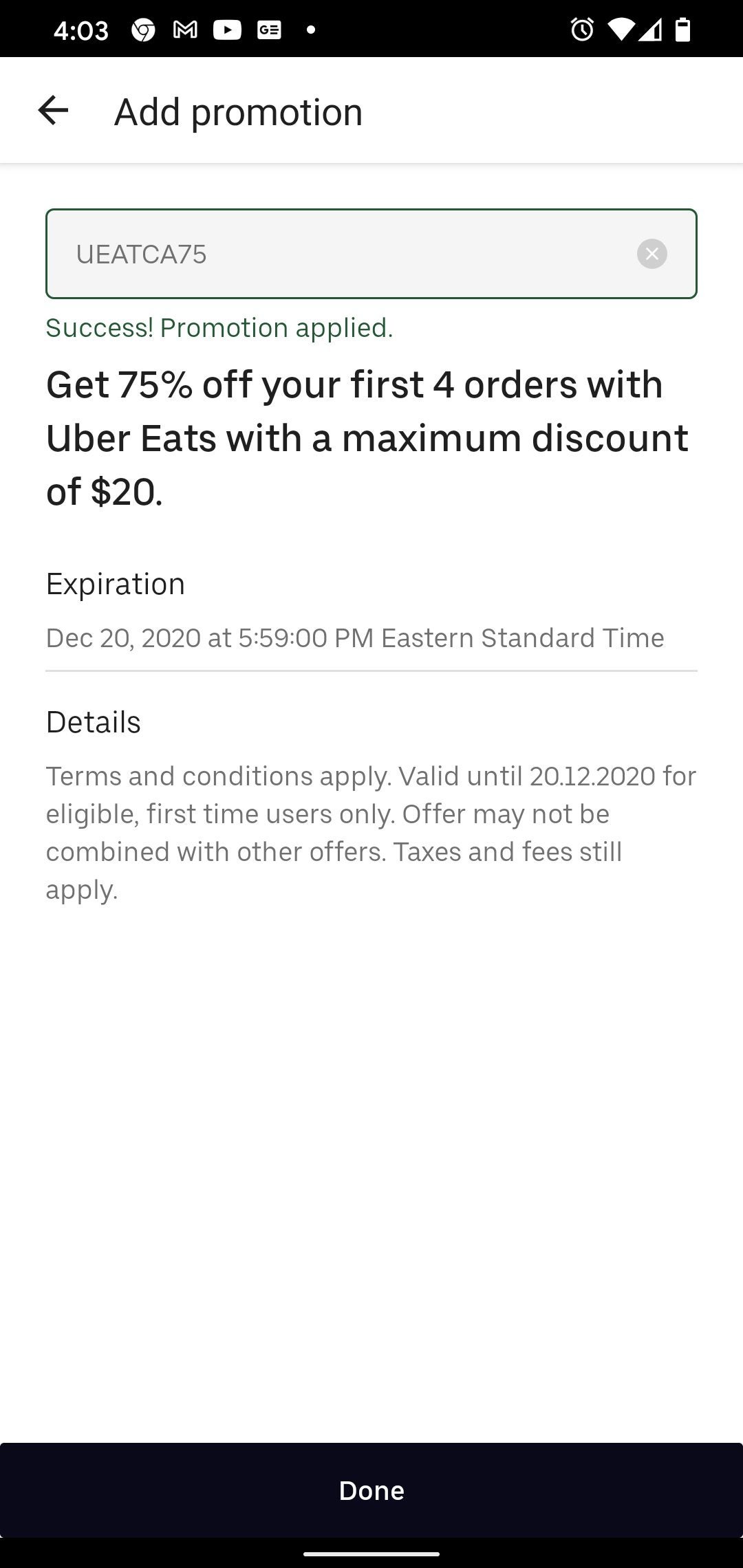

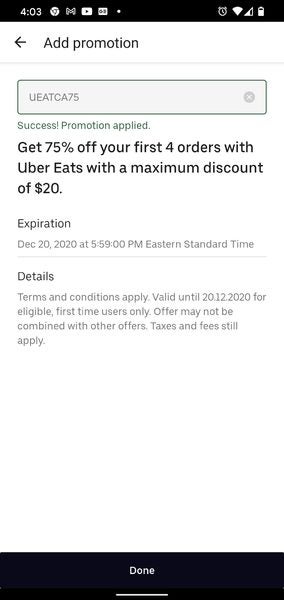

Uber Eats Uber Eats 75 Off 4x For New Users Ymmv Redflagdeals Com Forums

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Uber Gst Explained The Complete Guide To Gst For Uber Drivers

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Delivery Driver Tax Deductions Doordash Grubhub Uber Eats Instacart

Uber Gst Explained The Complete Guide To Gst For Uber Drivers

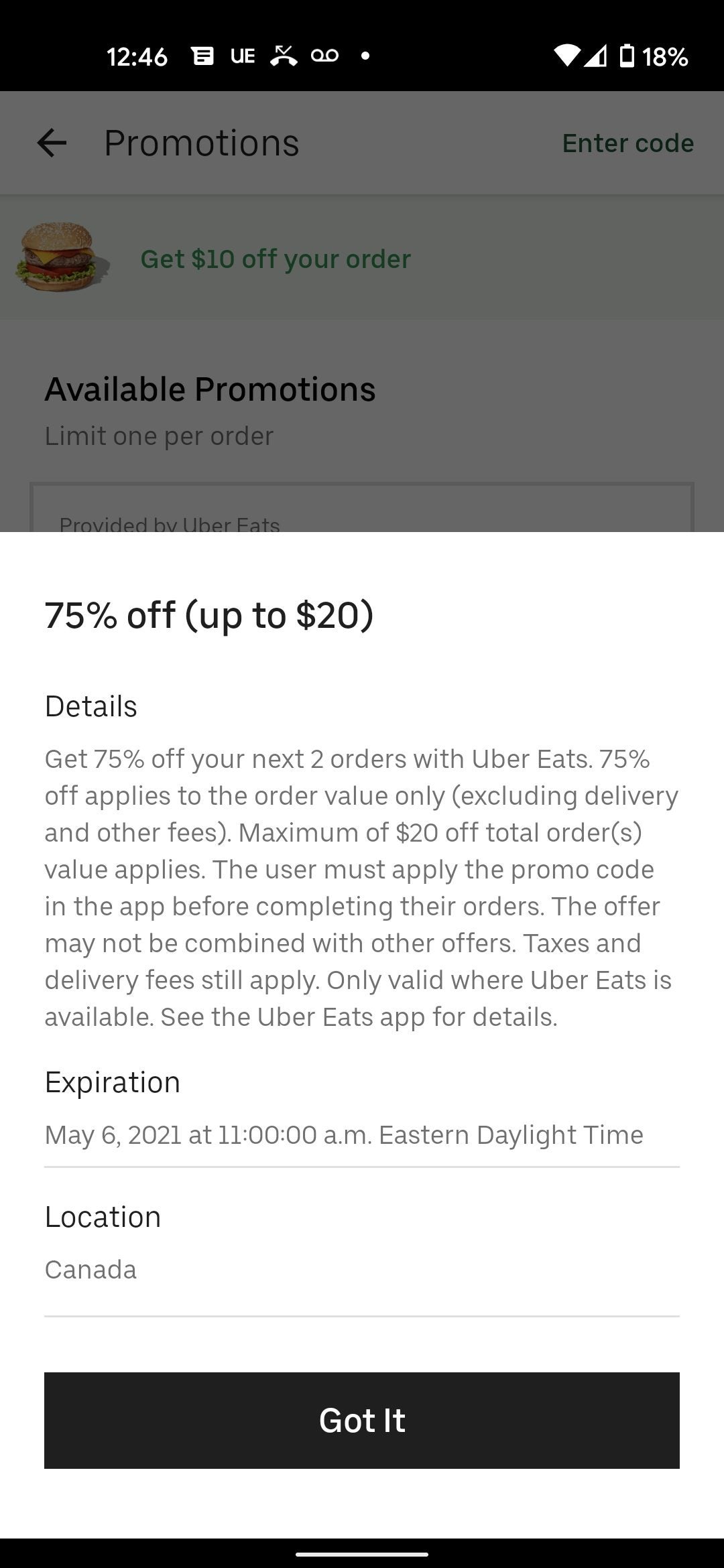

Uber Eats Ubereats 75 Off Up To 20 2 Times Ymmv Redflagdeals Com Forums

Uber Eats Uber Eats 75 Off 4x For New Users Ymmv Redflagdeals Com Forums

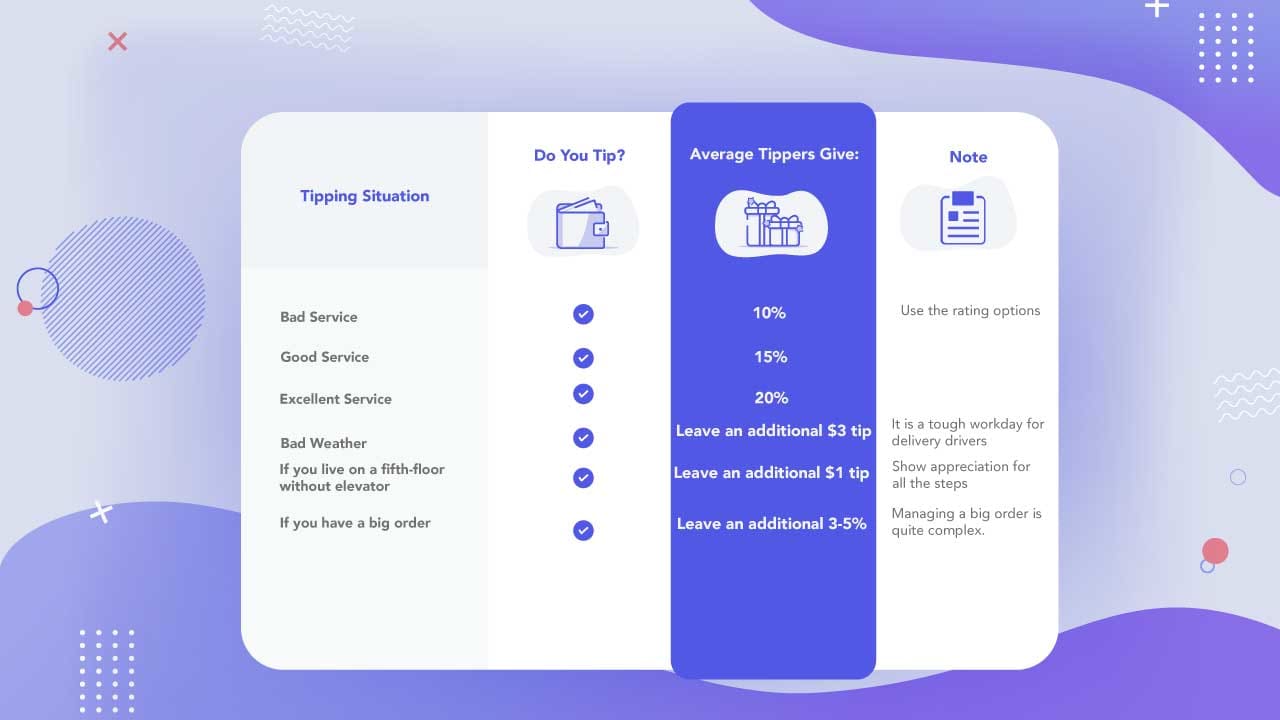

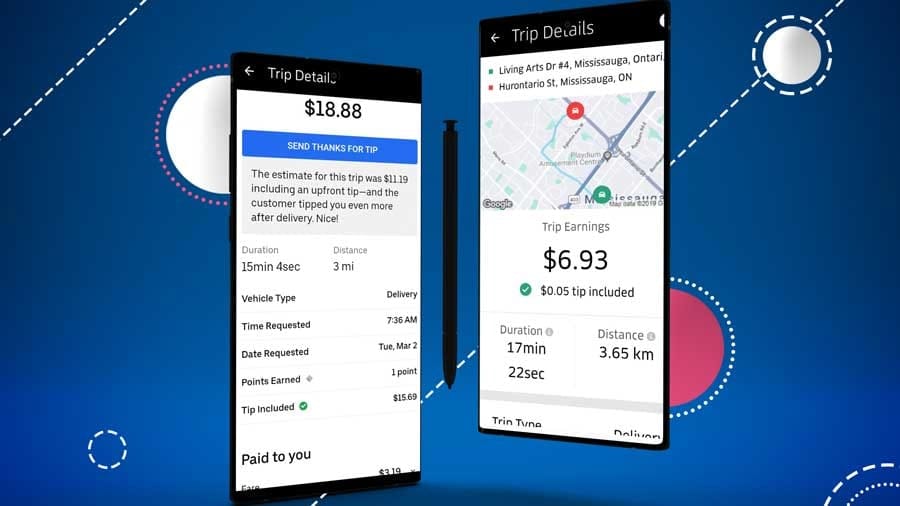

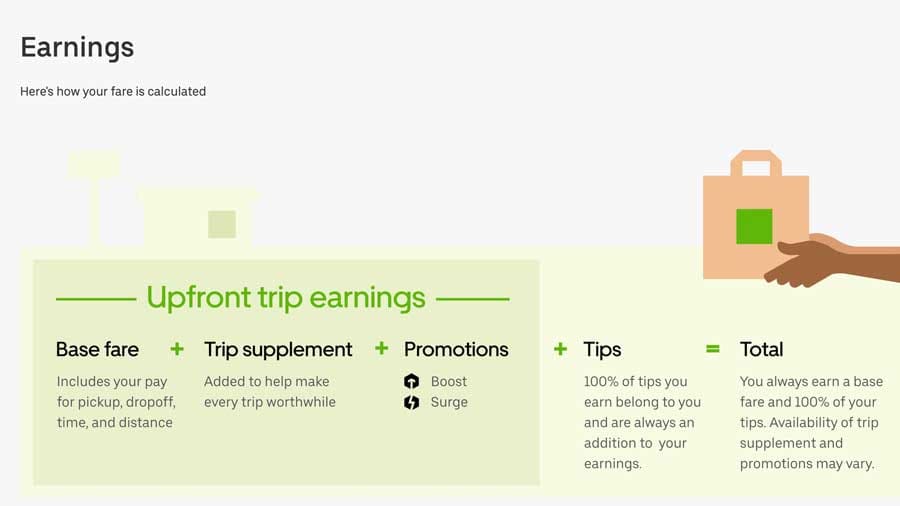

Do Uber Eats Drivers See Your Tip When You Order Food Online

Ubereats Hamilton Driver Pay And Requirements

Filing Taxes For On Demand Food Delivery Drivers Turbotax Tax Tips Videos

Uber Gst Explained The Complete Guide To Gst For Uber Drivers

Do Uber Eats Drivers See Your Tip When You Order Food Online

Do Uber Eats Drivers See Your Tip When You Order Food Online